Hidden costs of EU’s tariffs on Chinese electric vehicles – CGTN

China-Tajikistan Economic Cooperation Ushers in New Chapter – CGTN

2024-07-12FTZs set pace for China’s high-quality reform and opening up – CGTN

2024-07-12Editor’s note: Guo Bowei is an associate professor at the School of Applied Economics at Renmin University of China. Wu Tielong is a doctoral candidate at the School of Applied Economics at Renmin University of China. The article reflects the authors’ opinions and not necessarily the views of CGTN.

The European Commission plans to impose provisional anti-subsidy duties on electric vehicles (EVs) imported from China starting from July. This move has sparked strong opposition from various sectors of the European political and business communities, who believe that the EU’s action will have a series of negative consequences, including jeopardizing consumer benefits, hindering green transition, exacerbating inflation and obstructing the dissemination of advanced technologies.

European Union flags flap in the wind, Brussels, Belgium, June 27, 2024. /CFP

First, imposing anti-subsidy duties will harm EU consumers. Data from JATO Dynamics shows that in the first half of 2023, the average unit price of Chinese EVs in Europe was 48,600 euros, compared to 67,700 euros for EVs produced in other countries. This price advantage means that even if the anti-subsidy duties on Chinese EVs are raised by 20 percent, Chinese EVs will still have a competitive edge in the European market. The result of the tariff increase will either raise the cost for EU consumers purchasing Chinese EVs or force them to opt for lower-quality EVs produced in other countries. Either outcome will harm the interests of EU consumers.

Second, imposing anti-subsidy duties will hinder EU’s green transition. EVs are a crucial means of achieving green transformation in the transportation industry. Promoting EVs helps the EU reduce carbon emissions and meet its climate goals. However, increasing anti-subsidy duties will raise the price of EVs, reducing their market appeal and consequently affecting their adoption rate in the EU, slowing down the green transition process. Particularly, as China is the world’s largest producer of EVs with mature production technology and supply chain networks, its EV products have significant competitive advantages in both price and technology. If the EU imposes anti-subsidy duties on Chinese EVs, it will not only shrink the market for EVs but also potentially force EU consumers to delay their purchases or choose traditional fuel vehicles, which would negatively impact the EU’s green transition.

Furthermore, imposing anti-subsidy duties will exacerbate inflation. Statistics show that in 2023, the EU’s inflation rate reached 3.4 percent. As an important consumer product, the price increase of EVs will directly affect consumer spending levels, leading to higher living costs and further driving up the inflation rate. Amid the current fragile global economic recovery, heightened inflation will further weaken consumer purchasing power and suppress economic growth.

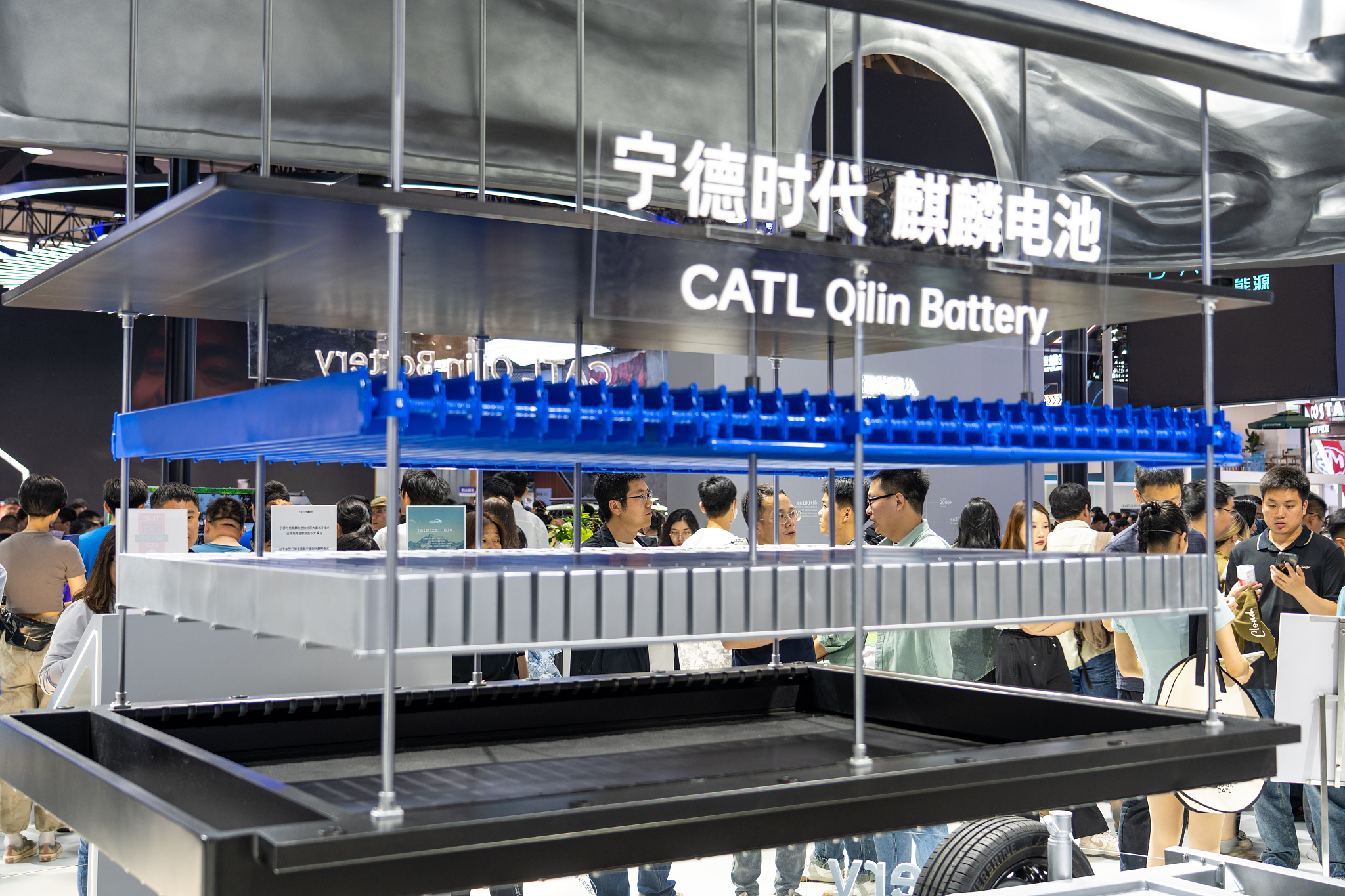

CATL Qilin battery on display at the 2024 Beijing International Automotive Exhibition, Beijing, China, May 3, 2024. /CFP

Finally, imposing anti-subsidy duties will obstruct the dissemination of advanced technologies. China holds numerous leading technologies in the field of EVs, especially in battery technology and intelligent driving. Statistics show that in 2023, the market share of CATL and BYD in global power battery installations reached 53 percent, with CATL’s battery technology being particularly outstanding, used by renowned automobile brands such as BMW and Mercedes-Benz in their EVs. By imposing anti-subsidy duties on Chinese EVs, the EU not only restricts the introduction and application of advanced technologies in its region but also risks triggering technology blockades and trade barriers, hindering global technological exchange and cooperation.

In addition to direct economic impacts, the broader implications of imposing anti-subsidy duties must be considered. The EU’s decision could set a precedent for similar protectionist measures globally, potentially leading to a fragmented market that undermines the efficiency of international trade and cooperation. This could be particularly detrimental in the rapidly evolving EV sector, where cross-border collaboration is essential for innovation and cost reduction.

Moreover, the geopolitical ramifications cannot be ignored. The imposition of such duties could escalate trade tensions between the EU and China, two major players in the global economy. This could lead to retaliatory measures from China, affecting not only the automotive sector but other industries as well, thereby creating a ripple effect that disrupts global supply chains and economic stability.

New EVs produced by BYD set to be exported at Ganzhou International Inland Port, Jiangxi Province, China, November 28, 2023. /CFP

From a policy perspective, the EU needs to balance its industrial and environmental objectives. While protecting domestic industries is important, it should not come at the cost of higher consumer prices, slower green transition and hindering technological progress. Instead, the EU could consider alternative strategies such as investing in domestic EV production, fostering innovation through subsidies and grants and enhancing collaboration with Chinese manufacturers to leverage their technological advancements.

In conclusion, EU’s imposition of anti-subsidy duties on Chinese EVs is unlikely to improve the lagging state of EU’s EV industry and may instead bring a series of adverse socio-economic impacts. Therefore, the EU needs to carefully consider the long-term implications of this decision to ensure that its policies genuinely promote both economic development and environmental protection for a win-win situation. By fostering an open, collaborative, and competitive market, the EU can better achieve its goals of green transition and technological advancement while safeguarding consumer interests and economic stability.